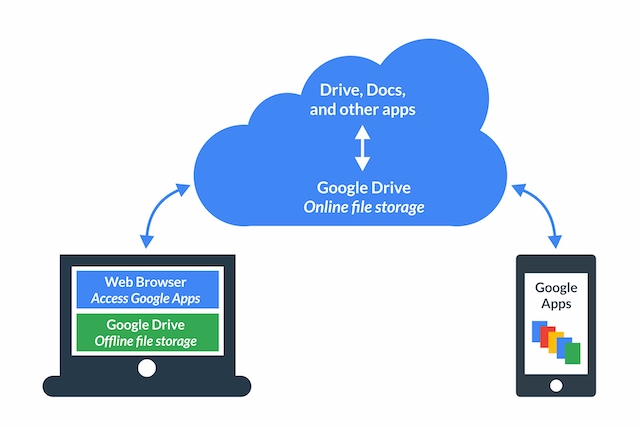

I recently purchased a Chromebook in a move to replace my Dell Laptop using Microsoft Office. I’m in the process of going through your guide and hopefully it will help me understand the use of the Google software and some structure of the Chrome OS. My biggest hangup right now is understanding when I’m working on this computer and when I’m actually working in the cloud. I wish they labeled the Drive and My Files differently to give me that feeling where I’m at and using their software. I’m used to manipulating files, dragging and dropping, making new folders, bringing in new files via USB and email attachments, and I see that does not work in every instance here (drag/drop). It is not the feel that I’ve had for years (C: A: D: E: drives) knowing where I’m working.

As the owner of a small business that will be impacted by the recent Supreme Court decision on online purchases and local tax collection (South Dakota vs. Wayfair), I hope the resulting outcry will be a catalyst for streamlining tax payments to local authorities across the country. But I’m not holding my breath.

In a perfect world, states would make things easier for out-of-state small businesses to pay taxes. Changes could include:

- Ending registration requirements at the state level

- Only taking annual filings instead of demanding monthly or quarterly filings

- Using a 1-page form for submitting taxes

- Accepting digital submissions & payments

But these are old-school state governments we’re talking about. Many are stuck in the past, or are restricted in their ways of thinking about the future.

And then there is the ugly fact that some bureaucrats and legislators LOVE to stick it to outsiders. Example: New Hampshire toll booths strategically placed along the Massachusetts border to collect money from vacationers and commuters using small stretches of state or interstate highways. Or, state-level protectionism for local businesses. I’ve encountered this trying to sell books and educational aids to local school districts in the South. Either you can’t sell, or the paperwork requirements are astounding. These aren’t taxes, but they illustrate the mindsets of many state legislatures and bureaucracies when it comes to dealing with out-of-staters.

When it comes time for state lawmakers and officials to craft tax laws for out-of-state small businesses post-#SDvWayfair, they won’t necessarily be thinking of making it easier to file. They’ll think: Why not adapt existing frameworks/processes, with a dollop of extra red tape on top?

Regarding technology such as digital submissions of tax data and easy online payments: If the Massachusetts Department of Revenue (the agency my Massachusetts corporation deals with) is anything to go by, small businesses will basically be dealing with tech that’s 10 years out of date in terms of functionality, and twice as difficult to use as commercial platforms.

Regarding technology such as digital submissions of tax data and easy online payments: If the Massachusetts Department of Revenue (the agency my Massachusetts corporation deals with) is anything to go by, small businesses will basically be dealing with tech that’s 10 years out of date in terms of functionality, and twice as difficult to use as commercial platforms.

Monumental changes in the nation’s legal framework are often an opportunity to make improvements in the way laws are implemented. But when it comes to the South Dakota vs. Wayfair Supreme Court ruling, I fear they’ve just given 50 state governments and assorted territories an excuse to screw the little guy.

I recently received a panicked email from a reader of Dropbox In 30 Minutes who had a question about Dropbox recovery — specifically, recovering shared files:

I recently received a panicked email from a reader of Dropbox In 30 Minutes who had a question about Dropbox recovery — specifically, recovering shared files:

My name is [redacted]. I have a small recording studio in my home. I have been mixing songs for a Gospel music CD for a client over a couple of weeks. Music is being recorded in various studios around town, and when files are completing they Dropbox them to me and I mix them.

One of the studio engineers sent the files to me one night then called the next morning and ask if he could erase the files on his computer because he needed the space to record a new project. By now you may have guests what comes next. Yep. Whatever rubbed him the wrong way about the producers or the singers or ????

In about 5 days those files where deleted from Dropbox. I never had a chance to download them. Is there anyway to retrieve files that were never downloaded at my end?

There is a lot of time and money and fantastic music to be lost here. The master has to be delivered on Monday. I hate to think that legal action would be an option. I’m not even sure who’s at fault.

Wow, this sounds pretty serious. As someone who once worked in the music industry, I know that losing studio recordings is a big deal. However, in this case, I don’t think it’s necessary to bring in the lawyers, as Dropbox recovery features would likely be available. Here is my response:

Sorry to hear about the problem you are having. If you have never accessed the deleted files, you can’t access them now. HOWEVER, the person who created them CAN recover them if it’s within a certain time period (30 days for free accounts, longer for paid accounts) AND he hasn’t permanently deleted them (most people don’t know how to do this, fortunately). He can then reshare them with you.

This is what I advise:

- Have your collaborator log on to the Dropbox website.

- He should click on Files > Deleted Files and find the folder with the music files.

- Click the file and select RESTORE

At that point, the files will resync to his or her computer. He can reshare them from the computer or from the Dropbox website. Even if he doesn’t have room on his computer to sync the restored files, they can still be shared from the Dropbox website. The links to share will be different than the old links from 5 days ago. IMMEDIATELY sync them and import them into your mixing program so they won’t be lost again!

Good luck with your project, and send me a link to a sample when they’re mixed and mastered!

There are a few morals to this story:

- If someone shares important files with you on Dropbox, sync them right away and create a backup. If the owner deletes them later, there is a strong chance no one will be able to recover them. The audio engineer above was lucky, as the deletion had just occurred and even free Dropbox accounts keep “deleted” files for 30 days (unless they are permanently deleted) and the other engineer could probably recover them. But I’ve talked with people who try to get deleted files from a shared Dropbox link months after the fact, and by the it’s too late. Dropbox recovery features simply won’t be available.

- If you deal with important work-related files, upgrade to Dropbox Professional, which includes a terabyte of storage space and extends the recovery period to 120 days.

For more tips about how to get the most out of Dropbox, check out Dropbox In 30 Minutes.

Video: How to recover a file or folder on Dropbox.com:

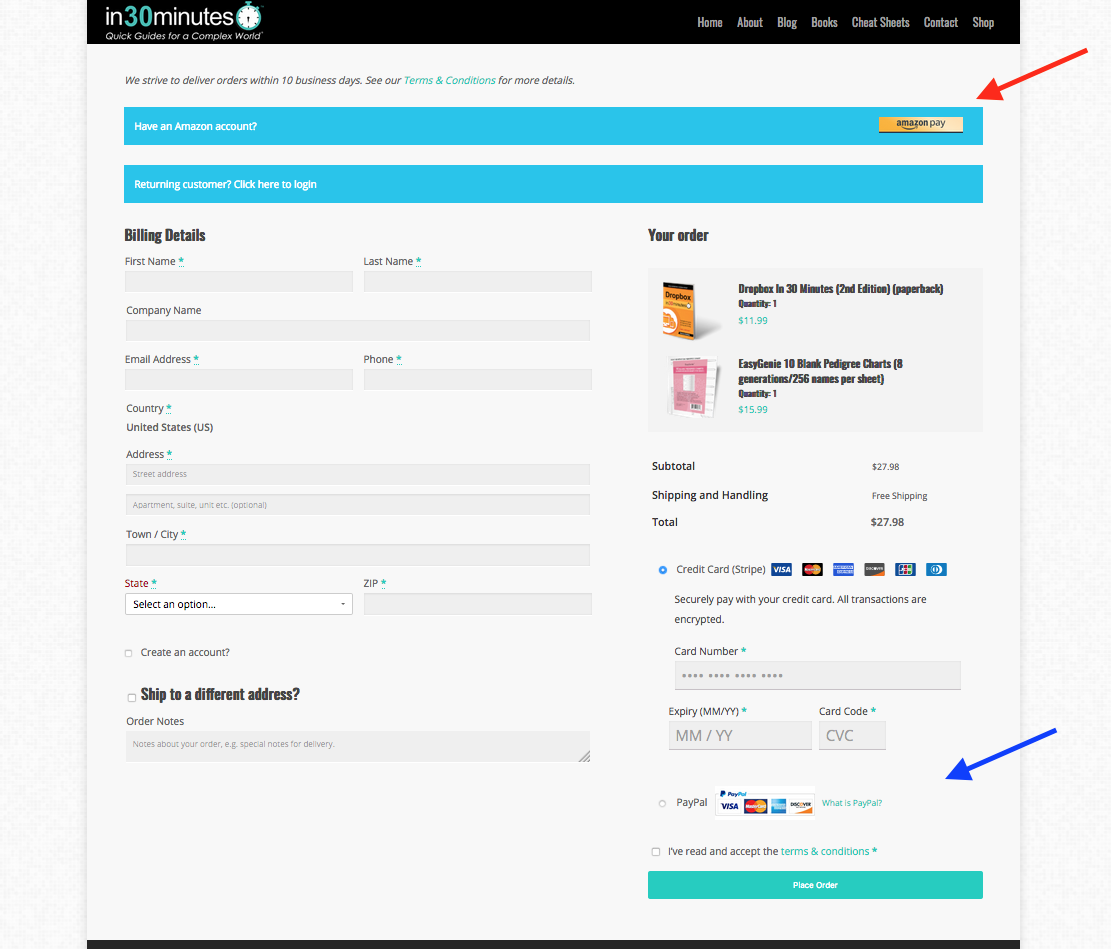

We recently set up e-commerce capabilities on in30minutes.com to make it easier for our customers to purchase In 30 Minutes guides, our line of technology cheat sheets, and EasyGenie genealogy forms. It wasn’t easy. Besides dealing with the WooCommerce settings in WordPress, there was additional work required to get an SSL certificate for the site (to protect our customers’ information and enable secure transactions), set up Stripe for credit card payments, load items into the store, and test the workflow.

Besides Stripe, I also enabled PayPal for transactions. That was straightforward, and afterwards the PayPal button appeared below the Stripe/credit card options on our shopping cart. So when I saw that Amazon offered similar functionality via the Amazon Pay WooCommerce extension (available via the WooCommerce site), and it allowed merchants to access the customer information (a big deal for shipping and other forms of contact) I was enthusiastic. A significant number of Americans (between 24% and half of households) have Amazon Prime accounts. If adding the Amazon Pay button makes it easier for customers to buy our products on our own store, that was great. I created my Amazon Merchant Account, installed the Amazon Pay WooCommerce extension, and followed the integration instructions.

The first thing I did was test the shopping cart. I was not happy with what I saw:

Instead of the Amazon Pay button appearing with the Stripe and PayPal options (blue arrow), the Amazon Pay WooCommerce extension forces the button to the top of the screen (red arrow) with a giant prompt asking customers whether they had an Amazon account. It’s the first thing customers will see, even before the products they have ordered. Ideally, the Amazon Pay button should appear next to the Stripe and PayPal options, not at the top of the page with a giant banner screaming for people to use it. Neither PayPal nor Stripe demand such behavior from their merchant partners, so why should Amazon?

I am not the only person to have problems with the setup of the Amazon Pay WooCommerce extension screen options. And they apparently cannot be changed, short of messing around with custom PHP work.

So, the choice is simple. We’re deactivating the Amazon Pay WooCommerce extension. Maybe they’ll add an option to remove the banner and relocate the button to the bottom of the page where it belongs. Until then, visitors to our store are welcome to use PayPal or a credit card to make purchases. Our products are also for sale on Amazon, Barnes & Noble, and other locations.

I recently received an email from a self-published author who wanted to know whether he should get a distributor or agent for his book. He had printed up 1,000 copies using a China-based printer, and wanted to know how he could get them into stores or noticed by an agent.

My answer: Getting distributors for printed books is extremely difficult … and probably not worth it. In-store retail paperback sales are falling While print sales have shown signs of life, margins are thin, there has been a lot of consolidation in the industry (or outright closures), and the distributors who remain are extremely picky about who they sign.

I tried for more than a year to get a distributor for In 30 Minutes guides on the terms that I wanted. The terms were key, as our guides are already very inexpensive. Selling the books at a wholesale rate (typically a 55% discount off the cover price) and giving the distributor a cut would lead to a gross profit of just a dollar or two per copy. Moreover, print distributors demand control (and a cut) over ebook distribution even though they add practically no value to this side of the business. Finally, distributors require publishers to adhere to their sales and marketing playbooks. That might be OK for some publishers, but not for i30 Media — in fact it would add significant delays and expenses to our production and marketing processes.

I ended up abandoning the effort to find a distributor. I now handle wholesale and direct distribution on my own through Createspace, Ingram, Baker & Taylor, and a short-run digital printer. While it’s true I am missing out on some brick-and-mortar retail sales, it works a lot better for my business — I have more control over my product, keep more money from sales (gross profit is 2x-3x more than what it would be through a distributor), and if retailers want to order the book they can do so through Ingram iPage or contact i30 Media directly through our contact form.

What about agents for self-published books?

As for the question about agents, my response was similar. Reputable ones will want to see evidence of very strong sales on Amazon before talking with a self-published author. And frankly, if your self-published books already has good sales on Amazon, why would you need an agent or a publisher? It’s questionable whether the traditional agent/publisher approach can improve sales for most authors. Even if an agent scores an advance, it won’t be much, and they will end up taking more money from both retail and online sales, leaving just a small cut for the author. Many readers of this post may be surprised to learn that big publishers seldom market books by new authors.

The questions about distributors, agents, and publishers come up a lot. Many people who are new to publishing assume that these players from the 20th-century publishing world are something to aspire to, or are required for success. The reality is it is possible to publish and profit in the 21st-century industry without going through agents, distributors, or big-name publishers in New York. Yes, it requires more investment on the author’s part to edit a manuscript, find a professional cover design, and market the book, but it is doable.

As for the author who contacted me, it turns out that he had self-published a cookbook. I told him that for a book like this, it will be either local bookstores in the community or special venues that will provide the best opportunities to sell cookbooks. Special venues could be a farmer’s market, a community or school fair, or flea markets. At IBPA’s Publishing University conference last year, I heard a presentation by poet/author Kwame Alexander who said that he was able to sell thousands of copies of one of his books at farmer’s markets, based on his wife’s suggestion — and he wasn’t even trying to sell a cookbook, which would be an even better match for people buying fresh ingredients.

Another option: volunteering to speak about the dishes or giving a cooking class … and then marketing the book to attendees.

As for online efforts, I would try the following:

- Create a website for the book with links to Amazon or other options to buy

- Create some simple videos on YouTube with a link to the book website.